Have you ever wondered whether a spouse has a rightful claim to a personal injury settlement in the state of California? The legal landscape surrounding personal injury cases can be complex, and understanding the rights and limitations of spouses in such situations is crucial. In this article, we delve into the intricacies of personal injury settlements in California and shed light on whether a spouse can indeed pursue a share of the settlement.

In short, the answer is not a straightforward “yes” or “no.” The accessibility of a personal injury settlement by a spouse in California depends on several factors, including the nature of the settlement, the community property system, and the consent of the spouse. We’ll break down these elements and provide you with a comprehensive understanding of how spousal rights are intertwined with personal injury settlements in the Golden State.

So, if you’re curious about the rules governing personal injury settlements in California and whether your spouse can lay claim to your settlement, read on. We’ll navigate through the legal nuances together, ensuring you’re well-informed and prepared for any potential scenarios that may arise. Your peace of mind and legal clarity await in the following sections.

Understanding Personal Injury Settlements in California

In the vibrant legal landscape of California, where personal injury cases can be as diverse as the state itself, it becomes imperative to comprehend the intricate dynamics of personal injury settlements. To embark on this journey of understanding, we’ll dissect the core elements of personal injury settlements in the Golden State in this segment.

Personal Injury Settlements Unveiled

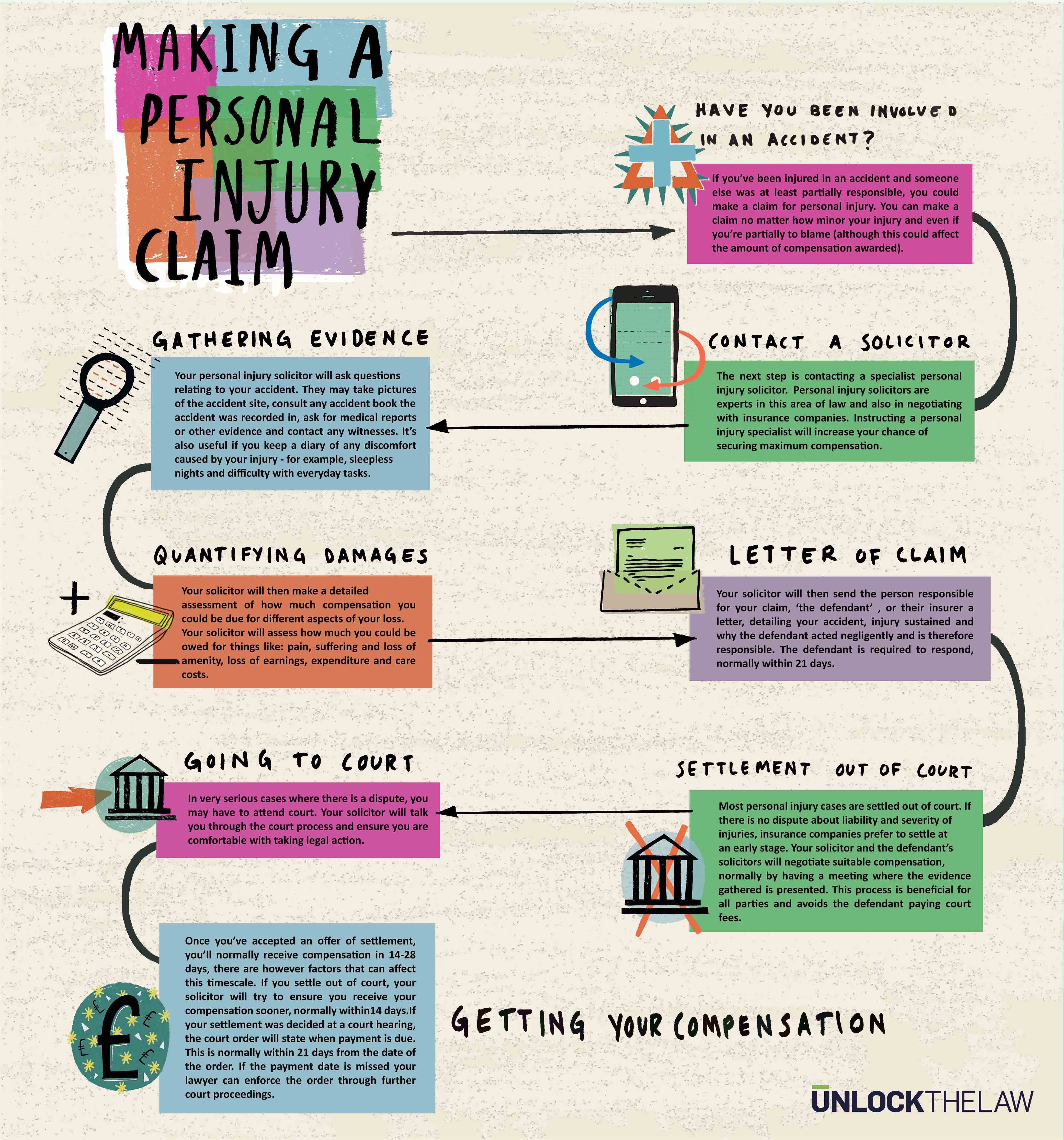

At its core, a personal injury settlement is a legally binding agreement that occurs outside the courtroom. It represents a negotiated resolution between the injured party (plaintiff) and the responsible party (defendant) to compensate the victim for their damages. This compensation typically comes in the form of financial reimbursement and is aimed at addressing the physical, emotional, and financial toll inflicted by the injury.

Common Types of Personal Injury Cases

The realm of personal injury in California is vast, encompassing a myriad of scenarios where individuals can sustain harm due to another party’s negligence or wrongful actions. Some of the most prevalent personal injury cases in the state include:

Car Accidents: With California’s bustling roads, motor vehicle accidents, ranging from minor fender-benders to catastrophic collisions, are unfortunately common. Personal injury settlements often revolve around securing compensation for medical expenses, vehicle repairs, and pain and suffering.

Slip and Fall Incidents: Property owners have a responsibility to maintain safe premises. When someone slips, trips, or falls due to negligence in property upkeep, they may pursue a personal injury settlement to cover medical bills and other associated costs.

Medical Malpractice: In the healthcare sector, medical malpractice cases arise when a healthcare provider’s negligence results in harm to a patient. Personal injury settlements in these cases may involve compensation for medical expenses, lost wages, and long-term care needs.

Product Liability: Defective products can lead to injuries, and personal injury settlements often seek to hold manufacturers and distributors accountable for damages caused by faulty items.

Workplace Injuries: California’s workforce is vast, and workplace injuries can have serious consequences. Personal injury settlements may involve claims against employers or third parties for injuries sustained on the job.

The Role of Insurance Companies

Insurance companies are significant players in the realm of personal injury settlements. In many cases, they are responsible for compensating the injured party, as individuals and businesses typically carry liability insurance. When an accident or injury occurs, the injured party often files a claim with the at-fault party’s insurance provider.

Insurance companies assess the claim’s validity, investigate the circumstances surrounding the incident, and negotiate settlements. Their primary aim is to minimize payouts while still fulfilling their contractual obligations. This is where skilled personal injury attorneys often come into play, advocating for the injured party’s rights and negotiating with insurance companies to secure a fair settlement.

Understanding these fundamental aspects of personal injury settlements in California lays the groundwork for comprehending the complex web of rights and responsibilities involved in these cases. While the process can be daunting, having a thorough understanding of what a personal injury settlement entails, the common types of cases it encompasses, and the role of insurance companies can empower individuals seeking rightful compensation in the aftermath of an injury.

Community Property System in California

In the realm of California law, the Community Property System stands as a defining feature of the state’s legal landscape, wielding substantial influence over marital assets, including personal injury settlements. Let’s delve into this intricate framework to grasp its nuances and implications.

California’s Community Property System Unveiled

California is among the few states in the U.S. that adheres to the Community Property System, a legal doctrine governing the division of property and assets acquired during a marriage. In essence, it establishes that most property acquired by either spouse during the marriage is deemed community property, owned equally by both partners, regardless of who earned or acquired it.

Separate vs. Community Property

To understand the impact of this system on personal injury settlements, it’s crucial to differentiate between separate and community property. Separate property includes assets and property acquired by one spouse before marriage, during marriage through gift or inheritance, or after a legal separation. Community property, on the other hand, encompasses all assets and income generated during the marriage, with a few exceptions, such as inheritances received by one spouse alone.

Categorizing Personal Injury Settlements

Now, let’s shed light on how personal injury settlements are typically categorized within this framework. When a personal injury claim results in a settlement, it often includes compensation for various elements, such as medical expenses, lost wages, and pain and suffering. The classification of these settlement funds as either community or separate property hinges on the nature of the damages being compensated.

Compensation for Marital Expenses: If the personal injury settlement is intended to reimburse the injured spouse for medical bills incurred during the marriage or to cover lost wages that would have contributed to the family’s finances, it’s likely to be considered community property. The rationale here is that these funds are deemed to have benefited the marital community.

Compensation for Personal Damages: Conversely, when a settlement addresses the injured spouse’s pain and suffering, emotional distress, or other personal damages, it tends to be categorized as their separate property. This distinction is grounded in the principle that personal damages relate directly to the individual’s suffering and are, therefore, their separate entitlement.

Navigating the Waters

Understanding this nuanced categorization is vital for spouses involved in personal injury settlements. It can significantly impact the division of assets in case of divorce or the distribution of assets upon the death of one spouse. To ensure a fair outcome, it’s advisable for spouses to maintain meticulous records, clearly documenting the allocation of settlement funds towards various expenses and damages.

Can a Spouse Access the Settlement

Delving into the intricacies of personal injury settlements in California, the question of whether a spouse can access such settlements is a multifaceted one, influenced by various factors that warrant thorough exploration.

General Accessibility of Personal Injury Settlements by Spouses

The general accessibility of personal injury settlements by spouses hinges on several key aspects. While California’s community property system implies joint ownership of marital assets, personal injury settlements often introduce a layer of complexity. Here’s a breakdown:

- Community vs. Separate Property: Whether a personal injury settlement can be accessed by a spouse often depends on the classification of the settlement funds. If the settlement pertains to community property, it may be readily accessible by the spouse. However, if the settlement addresses personal damages, such as pain and suffering, it’s more likely to be considered separate property, and thus, less accessible to the spouse.

The Source of Funds and Its Significance

Understanding the source of funds in a personal injury settlement is pivotal in determining spousal access. Funds originating from the injured spouse’s separate property, such as an inheritance or assets owned before marriage, typically remain their separate property. In such cases, the spouse may not have automatic access.

However, when settlement funds are directed towards expenses that benefit the marital community, such as medical bills or lost wages during the marriage, the community property aspect comes into play. This implies that the spouse may have a legitimate claim to a portion of the settlement, as it is considered to have contributed to the well-being of the marital unit.

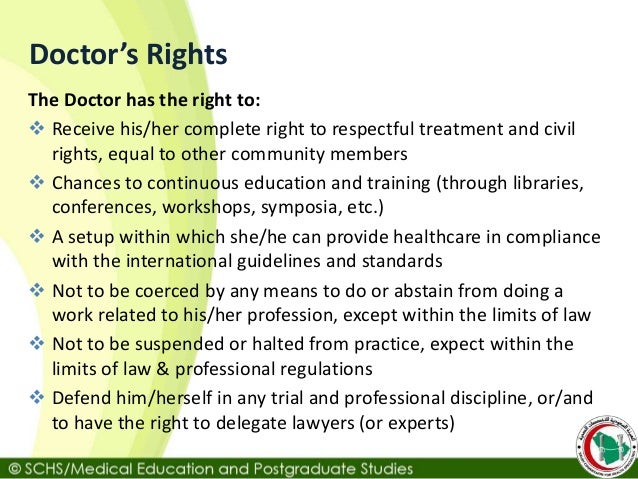

Legal Restrictions on Spousal Access

While the community property system forms the foundation, there are legal restrictions on spousal access to personal injury settlements, aimed at safeguarding individual rights and the sanctity of separate property. These restrictions can manifest in various scenarios:

Spousal Consent and Release: In some cases, spousal consent may be required for the injured spouse to access the settlement. This measure ensures transparency and agreement between spouses regarding the disposition of settlement funds.

Prenuptial Agreements: Prenuptial agreements, if in place, can exert a significant influence on spousal access. These agreements may stipulate specific terms and conditions regarding personal injury settlements, either upholding separate property rights or specifying a different arrangement.

Separate Property Claims: If the injured spouse can demonstrate that the settlement is rooted in their separate property, they may be able to protect it from spousal claims. This requires a clear distinction between community and separate property components within the settlement.

In summary, the accessibility of personal injury settlements by spouses in California is far from a straightforward matter. It hinges on the classification of settlement funds, the source of those funds, and legal restrictions. As the implications of spousal access can be intricate, seeking legal counsel is highly advisable to navigate this complex terrain effectively. In doing so, spouses can protect their individual rights and interests while upholding the principles of California’s legal framework.

Spousal Consent and Release

In the intricate legal landscape of California, the concept of spousal consent and release plays a crucial role in the realm of personal injury settlements. Understanding this concept is paramount for both spouses involved in such cases, as it pertains to the negotiation and distribution of settlement funds.

Concept of Spousal Consent and Release in California

Spousal consent and release refer to the legal requirements in California that often necessitate the agreement and formal release of one spouse for the other to access and distribute the proceeds of a personal injury settlement. In essence, it ensures that both spouses are in agreement regarding the disposition of settlement funds, safeguarding the rights and interests of each party.

Significance of Obtaining Spouse’s Consent for Settlement

The significance of obtaining a spouse’s consent for a personal injury settlement cannot be overstated. It serves several crucial purposes:

Preservation of Marital Harmony: Consent and release mechanisms are designed to prevent conflicts and disputes within marriages. They facilitate open communication and understanding between spouses, ensuring that both parties are aware of the settlement terms and their implications.

Protection of Spousal Rights: In California’s community property system, where many assets acquired during marriage are jointly owned, consent and release forms protect the rights of both spouses. They ensure that neither spouse can unilaterally make decisions that may affect marital assets without the other’s knowledge and agreement.

Legal Requirement: In certain cases, obtaining spousal consent is not just a matter of practicality; it’s a legal requirement. This is particularly true when settlement funds are categorized as community property or when a prenuptial agreement stipulates specific conditions.

How Consent and Release Forms Work

Consent and release forms are legal documents that outline the terms and conditions of a personal injury settlement and require the signature or acknowledgment of both spouses. Here’s a breakdown of how these forms typically work:

Clear Communication: These forms provide a platform for clear and transparent communication between spouses regarding the settlement. They detail how the funds will be used, distributed, or allocated, leaving no room for ambiguity.

Voluntary Agreement: Spousal consent should always be voluntary and informed. Both spouses should have a full understanding of the settlement terms before providing their consent. This ensures that neither party feels coerced or pressured into agreeing.

Notarization: In many cases, consent and release forms are notarized to add an additional layer of authenticity and legal weight. A notary public witnesses the signatures of both spouses, confirming that they willingly and knowingly consent to the settlement terms.

Legal Requirement Compliance: If spousal consent is legally mandated, failing to obtain it can lead to complications. Courts may require proof of consent and adherence to community property laws, especially in the event of divorce or asset distribution upon the death of one spouse.

Exceptions and Special Circumstances

Navigating the labyrinthine terrain of personal injury settlements in California, one encounters scenarios where a spouse’s access to the settlement funds may be limited or entirely restricted. These exceptions and special circumstances shed light on the nuanced aspects of spousal rights and entitlements within the state’s legal framework.

Situations with Limited or No Access to the Settlement

Separate Property Claims: One of the most prominent exceptions arises when the personal injury settlement is unequivocally categorized as the separate property of the injured spouse. In such cases, the funds are considered their individual entitlement and may remain beyond the reach of the other spouse. This separation of property extends to assets acquired before marriage, inheritances, and gifts received by the injured spouse during the marriage but intended solely for them.

Prenuptial Agreements: Spouses with a carefully crafted prenuptial agreement may find that it stipulates specific conditions regarding personal injury settlements. These legal contracts often outline the division of assets and liabilities in the event of divorce or separation, potentially rendering certain settlement funds inaccessible to one of the spouses.

Lack of Spousal Consent: In situations where spousal consent is legally required but not obtained, access to the settlement may be hindered. Failure to secure consent can occur due to various reasons, such as a breakdown in marital communication or disputes between spouses. Courts may uphold the requirement for spousal consent, and non-compliance can complicate the distribution of settlement funds.

Disputed Community vs. Separate Property: Disputes may arise over the classification of settlement funds as community or separate property. When spouses cannot reach a consensus on whether the funds benefited the marital community or were intended solely for the injured spouse, legal battles may ensue. Such disputes can delay access to the settlement.

Exceptions and Unique Scenarios

Amid these exceptions, a range of unique scenarios can further complicate matters:

Commingled Assets: When personal injury settlement funds are commingled with marital assets, the task of distinguishing between separate and community property becomes intricate. This often necessitates expert legal guidance to navigate the complexities.

Post-Separation Settlements: In cases where a personal injury settlement occurs after legal separation or during divorce proceedings, the treatment of settlement funds may differ. They may be considered separate property, particularly if the injury occurred after the separation date.

Beneficiary Designations: Some personal injury settlements involve insurance policies or wrongful death claims that designate specific beneficiaries. In such cases, the settlement proceeds may bypass the deceased spouse’s estate altogether, impacting access for the surviving spouse.

In essence, exceptions and special circumstances surrounding spousal access to personal injury settlements in California underscore the intricate nature of marital property rights and legal nuances. Clear documentation, legal expertise, and adherence to the state’s community property laws are essential when navigating these complexities. Ultimately, understanding these exceptional scenarios is crucial for spouses seeking to protect their interests and rights in the event of a personal injury settlement.

Legal Counsel and Advice

In the intricate realm of personal injury settlements in California, seeking legal counsel and advice stands as an imperative step for both spouses involved. The significance of professional guidance cannot be overstated, as it serves as a crucial safeguard for rights, interests, and the intricate web of legal nuances in these cases.

The Importance of Seeking Legal Counsel

Navigating Complex Laws: Personal injury settlements in California are governed by a web of intricate laws and regulations. Understanding these legal complexities requires the expertise of an experienced attorney who can interpret and apply them effectively.

Protecting Rights: Legal counsel acts as a shield, protecting the rights of both spouses. Whether it’s ensuring a fair distribution of settlement funds or safeguarding separate property claims, an attorney serves as an advocate for their clients’ interests.

Negotiating Fairly: Attorneys possess the negotiation skills and legal acumen needed to secure fair and just settlements. They can engage with insurance companies, opposing parties, and the legal system on behalf of their clients to maximize compensation.

Mitigating Risks: In cases involving disputes, commingled assets, or legal complexities, attorneys are equipped to identify potential risks and mitigate them effectively. This proactive approach can prevent complications down the road.

Guidance for Protecting Rights and Interests

Maintain Clear Documentation: Spouses should maintain meticulous records of all financial transactions, medical bills, and expenses related to the injury. This documentation can serve as critical evidence when making claims for settlement.

Open Communication: Effective communication between spouses is essential. Both should be aware of the legal implications of the settlement, consent requirements, and potential division of funds. Transparency is key to avoiding misunderstandings.

Consultation with Legal Experts: Before signing any settlement agreement or consent forms, it’s advisable to consult with an attorney individually to fully grasp the implications. This allows for informed decisions that align with each spouse’s interests.

Steps for Finding an Experienced Personal Injury Attorney in California

Referrals and Recommendations: Seek referrals and recommendations from friends, family, or colleagues who have experience with personal injury cases. Their firsthand insights can lead to reputable attorneys.

Online Research: Utilize online resources to research attorneys with a focus on personal injury law in California. Read client reviews, assess their track record, and review their website for credentials.

Consultations: Schedule initial consultations with potential attorneys to discuss the specifics of your case. During these meetings, evaluate their expertise, communication style, and compatibility with your needs.

Bar Association Resources: The California State Bar Association offers resources for finding licensed attorneys in the state. This can be a reliable source to verify an attorney’s credentials.

Case Studies and Examples

Illustrating the intricacies of personal injury settlements and spousal access, real-life case studies and examples shed light on the diverse scenarios that individuals may encounter in California. These cases provide valuable insights into the outcomes and lessons learned, offering guidance and understanding to those navigating the complex terrain of personal injury law within the state.

Case Study 1: The Clear-Cut Separate Property Claim

In this case, John, a California resident, was involved in a car accident that resulted in a significant personal injury settlement. However, the funds were categorized as his separate property, stemming from an inheritance he received before marriage. His spouse, Sarah, sought legal counsel and learned that, given the clear separation of assets, the settlement remained John’s sole entitlement. The lesson here underscores the importance of distinguishing between separate and community property, especially when settlement funds have a distinct source.

Case Study 2: The Ambiguous Commingling of Assets

Mark and Lisa, a married couple in California, faced a challenging situation when Mark was injured in a workplace accident. The subsequent personal injury settlement was intended to cover medical bills and lost wages incurred during their marriage. However, over the years, their finances had become entangled, making it difficult to differentiate between separate and community property. With the assistance of a skilled attorney, they successfully navigated the complexities, ensuring that the settlement funds were allocated fairly, protecting their respective rights and interests.

Case Study 3: The Prenuptial Agreement’s Influence

Jennifer and Michael had a prenuptial agreement in place, specifying the division of assets in the event of divorce or separation. Unfortunately, Jennifer sustained injuries in a slip and fall accident, resulting in a substantial personal injury settlement. As per their prenup, personal injury settlements were treated as separate property. While this initially appeared to limit Jennifer’s access to the funds, their attorney was able to negotiate a mutually agreeable distribution, highlighting the importance of understanding and adhering to the terms of a prenuptial agreement.

Case Study 4: The Importance of Spousal Consent

Sophia and David were facing a personal injury settlement situation where David required access to the funds to cover medical bills and ongoing treatment. However, Sophia was hesitant to provide her consent. The legal requirement for spousal consent in California meant that David had to navigate the complexities of their marital relationship to obtain access. With the guidance of a seasoned attorney, they were able to resolve their differences and reach a mutually beneficial agreement, emphasizing the significance of effective communication and negotiation.

These case studies underscore the diversity of scenarios that can arise in personal injury settlements involving spousal access. Whether it’s a matter of separate property claims, commingled assets, prenuptial agreements, or spousal consent, each case offers valuable lessons. The outcomes highlight the importance of seeking legal counsel, maintaining open communication, and adhering to legal requirements to protect one’s rights and interests effectively. In the intricate landscape of personal injury settlements in California, these real-life examples serve as beacons of guidance, offering clarity and direction to those facing similar challenges.

Article bottom line

As a result, personal injury settlements in California are governed by the state’s unique community property system, which determines whether a spouse may pursue a share of the settlement. We’ve taken the complexity out of the equation so that you don’t have to make a decision based solely on the answer to one of these questions.

In order to determine their financial status, a person must first comprehend the source of funds and asset classification. Couples can certainly benefit from a portion of a settlement, especially if it falls under the definition of community property. Furthermore, legal requirements, such as spousal consent and release forms, could add a new layer of complexity.

To successfully navigate these complex issues, you must seek legal counsel. Personal injury attorneys in California can provide you with valuable advice in order for you to protect your rights and interests during the legal process.

When it comes to justice and compensation, you must remember that knowledge has power. When dealing with personal injury cases in California, you should always stay informed and proactive in order to make informed decisions that benefit both you and your spouse.