Have you ever wondered what would happen if you were involved in a car accident and found yourself with hefty medical bills and complex legal problems? Personal injury insurance provides a crucial safety net for both drivers and pedestrians. This guide will go into great depth about bodily injury insurance, revealing the significance of the policy, covering details, and everything else you need to know about this crucial part of insurance coverage.

In essence, bodily injury insurance serves as a guardian angel in the event of an accident. A policy provides coverage for medical expenses, lost wages, and even legal representation in the event that you are held liable for another person’s injuries. You’ll be prepared for unforeseen situations by learning how this insurance works, allowing you to stay safe on the road.

Wait a second, there’s more to this comprehensive guide than just the fundamentals. You will learn about key insights into the claims process, identify misconceptions to avoid, and investigate the legal and regulatory environment surrounding bodily injury insurance as you read this. By the end of this course, you will be able to make educated decisions about your insurance coverage and confidently navigate the often confusing world of insurance claims.

In that vein, we’re pleased to offer you the opportunity to learn more about bodily injury insurance with our upcoming series. This guide is your ultimate resource for breaking down the fundamentals of financial protection in a comprehensive way, from understanding coverage limits to breaking down the fine print. Let’s go over some tips to make sure you become an excellent policyholder.

Overview

Amid the intricate tapestry of insurance landscapes, one pivotal strand stands out—bodily injury insurance. In our comprehensive exploration, we unfurl the layers enshrouding this critical facet of financial security. Defined by its core tenets, bodily injury insurance emerges as a sentinel of protection, both for the policyholder seeking sanctuary in times of adversity and the inquisitive mind yearning to fathom the complexities of insurance parlance.

Embarking on this journey, we traverse a terrain replete with key contours, each holding insights that carve out a comprehensive understanding. The crux of bodily injury insurance lies in its ardent pledge to bear the brunt of medical expenses, emanating like a beacon of hope for the injured and wronged. Lost wages, a poignant consequence of accidents, find their solace within its fold, cushioning the financial blows that fate may deal. And beyond the tangible, it extends an intangible yet invaluable embrace—the compensation for pain and suffering, a recognition of the immeasurable toll accidents may exact. In the corridors of justice, it extends its hand once more, providing legal representation that navigates the labyrinthine realm of liability.

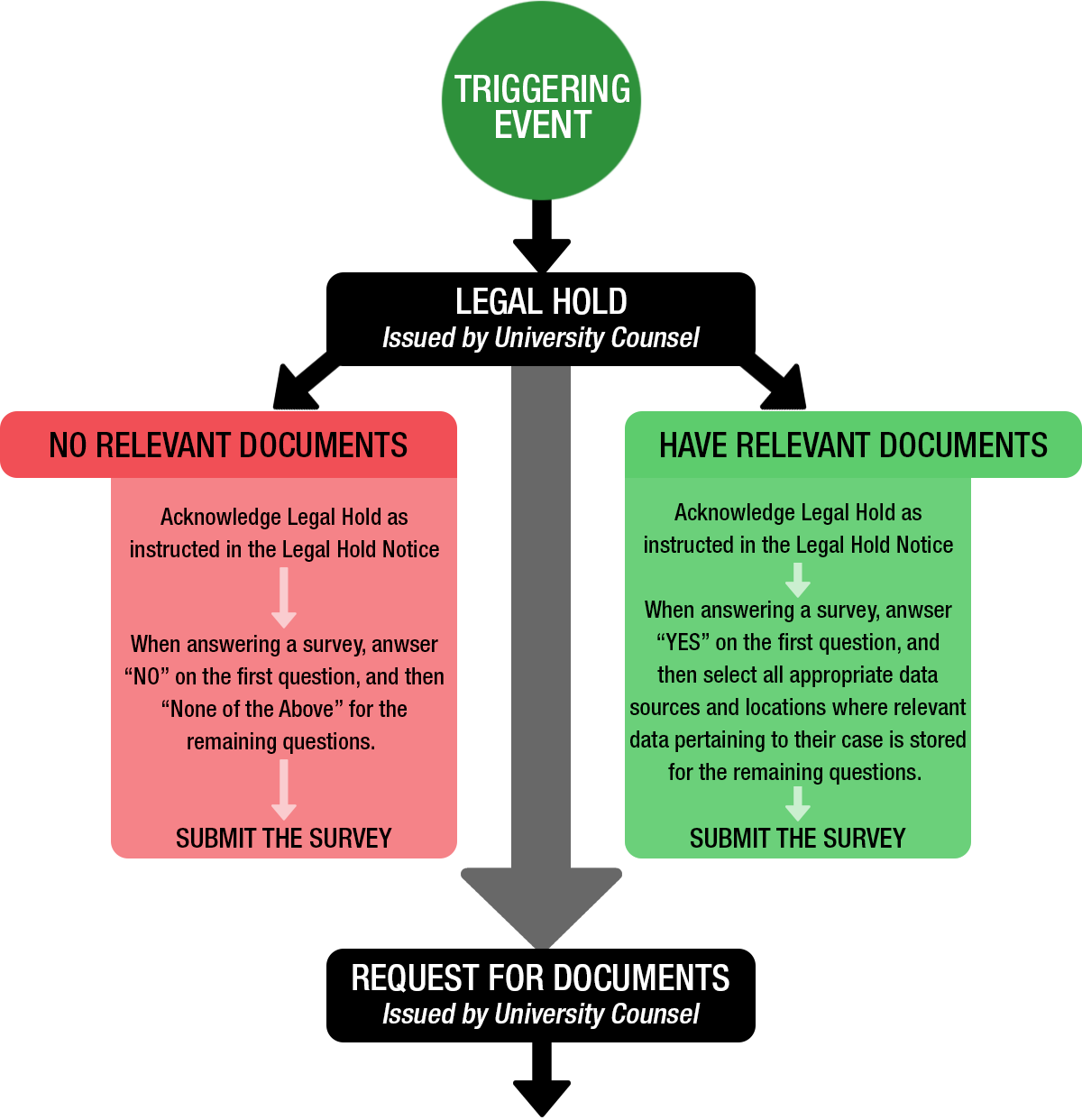

Navigating further, we unravel the claims process, a symphony orchestrated to transform distress into respite. Initiating a claim is the gateway to restoration, a process guided by meticulous steps and the expertise of claims adjusters—a liaison between the policyholder’s narrative and the claims ledger. Yet, time is a river, and understanding its flow—timelines, expectations, and documentation—bestows the power to steer one’s course with assurance.

In contemplating bodily injury insurance, the vista expands to encompass paramount considerations. At the crossroads, policyholders are met with choices—defining coverage limits, selecting stacking or non-stacking options, and pondering the shield of umbrella policies. The alchemy of these choices molds a safety net that mirrors individual circumstances, tailored and steadfast.

Diving deeper, a juxtaposition beckons—bodily injury insurance versus personal injury protection (PIP)—two sides of a coin endowed with distinct virtues. As we dissect their nuances, scenarios unfold, illuminating the paths each paves and the scenarios where one eclipses the other. Understanding these subtleties refines the art of insurance selection.

Amidst clarity, myths linger—an involuntary haze. Dispelling these illusions is paramount: the fallacy that bodily injury insurance blankets personal medical expenses; the mirage that its worth wanes in the presence of health insurance. Discernment arises as the antidote to misinformation, allowing decisions to be tethered to truth.

In this saga, legal and regulatory realms intertwine, and state-specific brushstrokes paint variations in requirements. As we traverse the mosaic of mandates and choices, a compass to compliance guides the way, ensuring a secure passage through the labyrinth of regulations.

As the curtain descends, a treasure trove of tips awaits the prudent traveler. Reading and deciphering policy documents unveils the map to one’s safeguard, while prudent post-accident steps pivot the trajectory from chaos to coherence. The echoes of wisdom resonate—regularly reviewing and updating coverage fortifies the ramparts of preparedness, shielding against the unforeseen.

Thus, with clarity as our lodestar, we emerge emboldened—befriending the realms of bodily injury insurance, taming its intricacies to harness its full potential. This guide is not a mere annotation, but an invitation—a key to unlocking the vaults of protection, empowering you to navigate the labyrinth of uncertainty with the armor of knowledge. As you chart your course forward, this guide shall remain an unwavering companion, illuminating your path to security, one insight at a time.

Table of Contents

Nestled within the expansive realm of insurance, the concept of bodily injury insurance emerges as a beacon of financial protection, a bulwark against the uncertainties that life’s highways may unfold. Embarking on a journey of elucidation, we unravel the intricate threads of bodily injury insurance, each strand contributing to a comprehensive tapestry of understanding. This multifaceted guide navigates through the diverse landscapes of coverage, liability, claims, and beyond, catering to both the discerning policyholder and the curious minds seeking insights into the labyrinthine world of insurance intricacies.

What is Bodily Injury Insurance? At the inception of our exploration, we unravel the very essence of bodily injury insurance, peering into its core facets. Defining this insurance variant unfurls its cloak of protection, enshrouding policyholders and those touched by accidents in a cocoon of security. The significance of bodily injury coverage, often intertwined with the broader ambit of liability insurance, unveils itself, an essential safeguard against the unforeseen.

Coverage and Benefits Diving deeper, we delve into the coverage and benefits bestowed by bodily injury insurance, unveiling its multifaceted offerings. From medical expenses coverage, a lifeline during times of injury-induced stress, to the respite of lost wages coverage, this insurance forms a robust safety net. It extends further, beyond the tangible, encompassing pain and suffering compensation, a testament to the recognition of intangible anguish. Legal representation coverage, an often-underestimated aspect, holds its role in the theater of justice, ushering in a sense of equity.

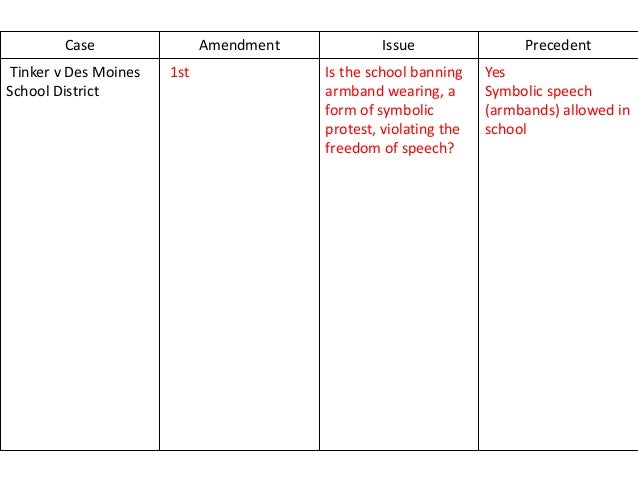

Understanding Liability Emerging from the cocoon of coverage, we pivot towards understanding liability—the cornerstone of many insurance narratives. The crux of liability in accidents comes to the fore, intricately linked to fault determination. Here, bodily injury insurance unfurls its role as both shield and ally, navigating the intricacies of liability cases, offering a defense against the tides of legal battles.

Claims Process Transitioning seamlessly, we navigate the terrain of the claims process—a pivotal juncture where policyholders seek solace amid turmoil. Initiating a bodily injury insurance claim becomes a testament to resilience, entailing the gathering of documentation as part of a meticulous dance orchestrated by claims adjusters. Timelines and expectations paint the canvas of this process, fostering an informed perspective.

Key Considerations As our journey continues, we arrive at a crossroads of key considerations—each choice shaping the contours of one’s insurance voyage. Minimum legal requirements form a bedrock, paving the path of compliance. The nuances of choosing coverage limits unravel, a delicate balancing act that encapsulates preparedness. Stacking and non-stacking options intermingle, and the umbrella of supplementary coverage beckons—an extra layer of armor against life’s uncertainties.

Cost Factors Shifting gears, we navigate the landscape of cost factors—a symphony composed by varied influences. Factors that sway premium rates emerge as influencers, from driving history’s indelible mark to the symphony of location’s impact. The concept of bundling, an orchestration of insurance harmonies, finds its resonance, offering potential savings and streamlined protection.

Comparing Bodily Injury Insurance vs. Personal Injury Protection (PIP) A tapestry woven with contrasts unfolds, inviting comparisons between bodily injury insurance and personal injury protection (PIP). The interplay between these insurance realms becomes evident as we differentiate between bodily injury and PIP, peering into scenarios where each type holds sway. Unveiling limitations and overlaps paints a clearer picture, facilitating choices informed by insight.

Common Misconceptions In this journey, myths stand as potential obstacles, casting shadows on the path of understanding. We debunk these misconceptions with clarity and data-backed precision. The myth that bodily injury insurance covers personal medical expenses is dispelled, revealing its true boundaries. Another fallacy, that bodily injury insurance loses relevance under the aegis of health insurance, crumbles under the weight of informed discernment.

Legal and Regulatory Aspects As our voyage navigates the regulatory landscape, the nuances of state-wise variations in requirements emerge—a testament to the intricate interplay of insurance laws. The dichotomy between mandatory and optional coverage unveils itself, beckoning policyholders to explore avenues aligned with their needs. Staying compliant with insurance laws becomes a cornerstone, fostering a harmonious relationship with legal mandates.

Tips for Policyholders As we near the crescendo, a trove of tips awaits policyholders, a compass guiding them through the labyrinth of insurance nuances. Decoding policy documents becomes an art, as policyholders master the language of protection. Steps to take post-accident unfold, orchestrating a harmonious response during chaotic moments. The echoes of wisdom resonate as policyholders embrace the rhythm of regularly reviewing and updating coverage—an evolution of protection.

In the grand tapestry of insurance narratives, the contours of bodily injury insurance emerge vividly, a symphony of protection and understanding. This guide stands as a testament—a repository of knowledge that empowers, an invitation to navigate the undulating terrains of insurance with acumen. As you journey forth, armed with insights and clarity, may the realm of bodily injury insurance become a terrain where security and understanding converge.

Related Questions

- What does bodily injury insurance cover?

Bodily injury insurance provides a crucial safety net by covering medical expenses, lost wages, and pain and suffering compensation for individuals injured in accidents. Additionally, it offers legal representation coverage when policyholders are held liable for injuries to others. This comprehensive coverage ensures financial protection for both policyholders and those affected by accidents, offering a shield against unforeseen challenges on the road of life.

- How does bodily injury coverage differ from personal injury protection (PIP)?

Bodily injury coverage primarily focuses on providing financial protection when the policyholder is at fault in an accident, offering compensation for injuries and legal representation for those affected. Personal injury protection (PIP), on the other hand, extends coverage to medical expenses, lost wages, and related costs for both the policyholder and passengers, irrespective of fault. While bodily injury coverage addresses liability scenarios, PIP offers a broader safety net, encompassing a wider range of medical and financial needs. Understanding these distinctions enables informed choices when selecting insurance coverage tailored to individual circumstances.

- What are the steps to file a bodily injury insurance claim?

To file a bodily injury insurance claim, follow these key steps:

Report the Incident: Contact your insurance provider promptly to inform them about the accident and injuries sustained.

Gather Documentation: Collect relevant documents, including medical records, accident reports, and any communication with involved parties.

Engage Claims Adjuster: Work closely with the claims adjuster assigned to your case. Provide comprehensive details and evidence to support your claim.

Medical Evaluation: Undergo a medical evaluation to assess injuries and determine treatment needs. Share medical reports with the claims adjuster.

Review Coverage: Understand your policy’s coverage limits and benefits related to bodily injury claims.

Negotiate Settlement: The claims adjuster will assess the claim and negotiate a settlement. Review the offer carefully and negotiate if needed.

Claim Approval: Once both parties agree, the claim is approved, and compensation is disbursed based on the settlement.

Release and Closure: Sign any necessary release forms, closing the claim process.

Navigating these steps diligently ensures a smoother process for filing a bodily injury insurance claim and securing rightful compensation.

- Can I choose my bodily injury coverage limits?

Yes, you can often choose your bodily injury coverage limits. Insurance policies typically offer options for coverage limits, allowing policyholders to tailor their protection according to their needs and preferences. Selecting higher coverage limits offers increased financial protection in case of accidents. However, it’s important to strike a balance between coverage and affordability. Evaluating factors like personal assets, potential risks, and budget constraints helps determine suitable coverage limits. Opting for adequate bodily injury coverage safeguards against potential liability, ensuring you’re prepared for unexpected situations on the road.

- Are there any myths about bodily injury insurance I should know?

Certainly, a couple of common myths surrounding bodily injury insurance deserve debunking. One prevalent misconception is that bodily injury insurance covers your own medical expenses. In reality, this coverage pertains to injuries sustained by others for which you’re liable. Another myth suggests that having health insurance renders bodily injury coverage unnecessary. However, health insurance doesn’t extend to cover liabilities resulting from accidents. Clearing these misconceptions empowers you to make informed decisions, ensuring you possess accurate knowledge while navigating the realm of bodily injury insurance.

- How does my driving history affect bodily injury insurance premiums?

Your driving history significantly influences bodily injury insurance premiums. Insurance companies assess your past driving behavior, including accidents and traffic violations, to gauge your risk profile. A clean record may qualify you for lower premiums, as it suggests responsible driving. Conversely, a history of accidents or violations may lead to higher premiums, reflecting an elevated risk. Maintaining a safe driving record can help secure favorable rates and demonstrate your commitment to road safety. It’s essential to be aware of how your driving history shapes your insurance costs, motivating responsible behavior behind the wheel and potentially reducing your insurance expenses.

- What are umbrella policies and how do they relate to bodily injury insurance?

Umbrella policies are supplemental insurance coverage that extends beyond the limits of your primary policies, such as bodily injury insurance. They provide an extra layer of protection, covering liability claims that exceed your underlying policy limits. While bodily injury insurance safeguards against injuries you may cause to others, an umbrella policy offers broader liability coverage, including bodily injury, property damage, and even personal injury claims. It acts as a safety net, shielding your assets from potential legal and financial consequences that may arise from severe accidents. Umbrella policies and bodily injury insurance complement each other, collectively fortifying your coverage portfolio and providing comprehensive protection against unforeseen liabilities.

- Is bodily injury insurance mandatory in all states?

Bodily injury insurance is not mandatory in all states, but it’s required in many. States that mandate it typically set minimum coverage limits to ensure financial responsibility in accidents. However, some states follow a no-fault insurance system, focusing on personal injury protection (PIP) instead. It’s essential to understand your state’s insurance laws and regulations to comply with coverage requirements. Even if not mandatory, having bodily injury insurance is highly advisable as it protects you from potential legal and financial liabilities in case of accidents where you are at fault. Comprehensive coverage aligns with responsible driving and safeguards your financial well-being.

- What should I do if the other driver doesn’t have bodily injury insurance?

If the other driver lacks bodily injury insurance, a few steps can help protect your interests. Firstly, ensure you have uninsured/underinsured motorist coverage as part of your own policy. This coverage helps compensate for injuries caused by drivers without adequate insurance. Secondly, gather as much information as possible about the uninsured driver, including their contact details and vehicle information. Document the accident scene and any injuries. Next, file a claim with your insurance provider, detailing the circumstances and providing the gathered information. They will initiate the claims process under your uninsured/underinsured motorist coverage. Remember, having this coverage can provide a crucial safety net in situations where the other driver is not adequately insured, offering you the necessary protection and peace of mind.

- How often should I review and update my bodily injury coverage?

Regularly reviewing and updating your bodily injury coverage is a prudent practice to ensure it aligns with your evolving needs. Major life events like marriage, having children, or changes in income may necessitate adjustments. Additionally, as your assets grow, increasing coverage can safeguard against potential liabilities. It’s advisable to review your policy at least annually, or whenever significant life changes occur. Staying proactive in this regard ensures your bodily injury coverage remains comprehensive and responsive, providing optimal protection in the face of unforeseen circumstances.